SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant Rule 14a-12 | |||

NORDSON CORPORATION | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

Not Applicable | |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

Not Applicable | |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

Not Applicable | |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

Not Applicable | |||

| ||||

| (5) | Total fee paid: | |||

| Not Applicable | ||||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

Not Applicable | |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

Not Applicable | |||

| ||||

| (3) | Filing Party:

Not Applicable | |||

| ||||

| (4) | Date Filed:

Not Applicable | |||

| ||||

NORDSON CORPORATION

Notice of 20122014

Annual Meeting

and Proxy Statement

28601 Clemens Road

Westlake, Ohio 44145

January 23, 201217, 2014

It is my pleasure, on behalf of your Board of Directors, to invite you to attend our Annual Meeting of Shareholders, which will be held this year at the Atlanta Marriott Alpharetta, 5750 Windward Parkway, Alpharetta, Georgia 30005,Nordson Corporation’s Headquarters, 28601 Clemens Road, Westlake, Ohio 44145 at 8:00 a.m. on Tuesday, February 28, 2012 at 8:30 a.m.25, 2014.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the items of business that will be discussed and voted upon during the meeting. It is important that you vote your shares of common stock whether or not you plan to attend the meeting. You have a choice of voting through the Internet, by telephone or by returning the enclosed proxy/voting instruction card by mail. You may also vote in person at the meeting. Please refer to the instructions in the enclosed materials. If you attend the meeting and wish to vote in person, the ballot you submit at the meeting will supersede your proxy.

We look forward to providing you a reportyour attending the Annual Meeting and, on Fiscal Year 2011 and the first quarter of Fiscal Year 2012 which ends January 31, 2012. On behalf of management and our Board of Directors, I want to thank you for your continued support and confidence in 2012.2014.

Sincerely,

JOSEPH P. KEITHLEY

Chairman of the Board of Directors

OF SHAREHOLDERS

To Be Held Tuesday, February 28, 201225, 2014

Date and Time: | Tuesday, February 25, 2014, at 8:00 a.m. | |

Place: | Nordson Corporation’s Headquarters, 28601 Clemens Road, Westlake, Ohio 44145. | |

Items of Business: | 1. To elect as directors three nominees, named in the Proxy Statement and recommended by the Board of Directors, to serve until the 2017 Annual Meeting of Shareholders and until their successors shall have been duly elected and qualified; 2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2014; 3. To cast an advisory vote to approve named executive officer compensation; and 4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | |

Record Date: | Close of business on December 27, 2013. | |

A Proxy Statement, Proxy/Voting Instruction Card, and Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the fiscal year ended October 31, 2013, accompany this Notice and are also available at:www.nordson.com/investors. The Board of Directors has determined that our shareholders of record at the close of business on December 27, 2013 are entitled to notice of, and to vote at, the Annual Meeting of Shareholders.

By Order of the Board of Directors,

ROBERT E. VEILLETTE

Vice President, General Counsel

and Secretary

Westlake, Ohio

January 17, 2014

1

This summary highlights information contained elsewhere in this Proxy Statement and in our Annual Report on Form 10-K. For more complete information about these topics, please review the complete Proxy Statement and Annual Report on Form 10-K. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

GENERAL INFORMATION

| 2014 Annual Meeting Time and Date | 8:00 a.m. Tuesday, February 25, 2014 | |

| Place | Nordson Corporation Headquarters 28601 Clemens Road Westlake, Ohio 44145 USA | |

| Items of Business/Proposals | 1. To elect as directors three nominees, named in the Proxy Statement and recommended by the Board of Directors to serve until the 2017 Annual Meeting of Shareholders and until their successors shall have been duly elected and qualified; 2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2014; 3. To cast an advisory vote to approve named executive officer compensation; and 4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | |

| Record Date | Close of business December 27, 2013 | |

| Voting | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for the election of directors and one vote for each of the proposals to be voted on. |

VOTING MATTERS AND RECOMMENDATIONS

| Voting Matter | Board Recommendation | |

Election as Directors Nominees: Keithley, Merriman, and Puma | FOR EACH NOMINEE | |

| Ratification of Ernst & Young as Independent Registered Public Accounting Firm for fiscal year ending October 31, 2014 | FOR | |

Advisory Vote to Approve Named Executive Officer Compensation | FOR |

GOVERNANCE HIGHLIGHTS

The following table summarizes our Board structure and key elements of our corporate governance framework:

| Governance Element | Comments | |

| Board Independence | Eight of our nine directors are independent under the Company’s Governance Guidelines and NASDAQ listing standards. All members of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee are independent. | |

| Independent Directors Meetings | Our independent directors meet in executive sessions after each regular board meeting without management present. | |

| Board Leadership Structure | Our Board is led by an independent Chairman, Joseph P. Keithley. | |

| Board Structure | Classified with three classes of directors. | |

| Voting Standard for Election of Directors | Plurality in uncontested elections. |

2

| Governance Element | Comments | |

| Stock Ownership Guidelines | To align director and executive officer interests with those of our shareholders, we have stock ownership guidelines for directors and executive officers. Each of the directors and executive officers satisfies the stock ownership guidelines or is within the grace period provided by the stock ownership guidelines to achieve compliance. | |

| Board Self-Assessments | Each year, the Governance and Nominating Committee of the Board of Directors administers self-assessments of the Board of Directors and its committees. | |

| Chief Executive Officer Evaluation | Each year the Board of Directors as a whole evaluates the performance of the Chief Executive Officer. | |

| Hedging/Pledging Transactions Prohibited | We have an insider trading policy that prohibits pledging, short sales and hedging of shares of our Common Stock by directors and executive officers. | |

| Performance-Based Compensation | We rely heavily on performance-based compensation for executive officers, including awards of performance-based stock. | |

| Clawback Policy | Our Board of Directors may require reimbursement of incentive compensation and/or equity awarded to an executive officer if we are required to restate all or a portion of our financial statements or the Compensation Committee determines that an executive officer has engaged in (i) conduct that violates our Code of Ethics and Business Conduct, or (ii) willful misconduct or fraud that causes harm to the Company. | |

| Advisory Vote on Executive Compensation | We conduct an annual shareholder advisory vote on compensation we pay to our named executive officers. | |

| Shareholder Rights Plan (“Poison Pill”) | We do not have a shareholders rights plan in place. | |

| Oversight of Risk | The Board as a whole exercises its oversight responsibilities with respect to material risks we face in a global market, including operational, financial, strategic, competitive, reputational, legal and regulatory risks. The Board has delegated responsibility for the oversight of specific risks to Board committees. | |

| Shareholder Proposals under Rule 14a-8 | Shareholder proposals for consideration for inclusion in our 2015 proxy statement pursuant to Rule 14a-8 of the Securities Exchange Act of 1934 must be delivered to us by September 13, 2014. | |

| Proposals and Director Nominations Submitted Pursuant to our Regulations | Notice of shareholder proposals and director nominees for consideration at our 2015 Annual Meeting of Shareholders, must be received by us no earlier than November 26, 2014 and no later than December 26, 2014. |

Fiscal year 2013 was a year of solid financial results for the Company in the face of a lackluster global economic recovery. Our ability to execute on all facets of the 2013 operating plan is reflected in the following benchmarks achieved:

| Operational Element | Comment | |

Revenue | Grew to a record $1.54 billion, an increase of 9.5% from a year ago | |

Gross Margin | 56% | |

Operating profit/margin | $324 million/21% | |

Net income | $222 million | |

Earnings Per Share | $3.42 | |

Return on Capital | 17.6% | |

Quarterly Dividend | $0.18 (increase of 20%) | |

Share Repurchase | Over the last three years we purchased 7.8% of Nordson’s outstanding shares at an average price of $47.16 per share, a discount of approximately 34.6% compared to the 2013 year-end closing price of $72.09 per share. | |

1-Year TSR | 23% |

3

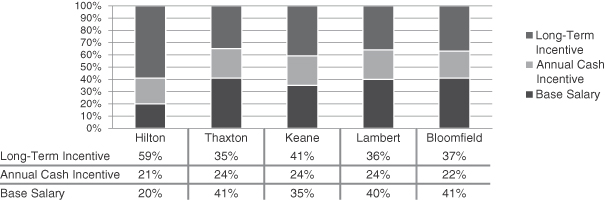

Fiscal year 2013 compensation of our named executive officers is described in the Compensation Discussion and Analysis in this Proxy Statement. The table below highlights compensation paid to our named executive officers. It does not include all of the information provided in the Summary Compensation Table presented later in this Proxy Statement. Additional information about our compensation philosophy and program, including compensation determinations for each of our named executive officers, can be found in the Compensation Discussion and Analysis in this Proxy Statement.

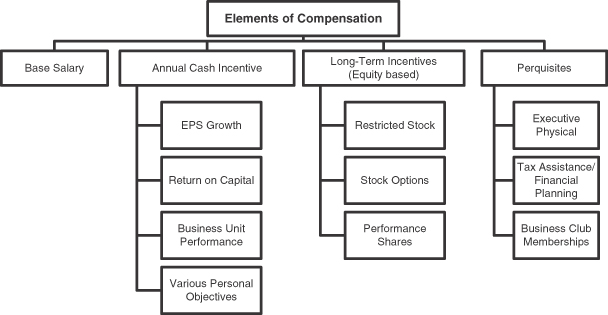

| Pay Component | Comments | |

| Base Salary | • Base salary increases for the named executive officers ranged from 3.1% to 6.7%. | |

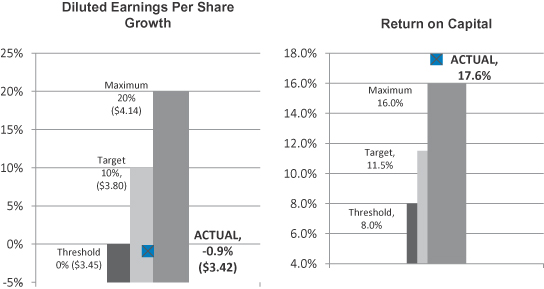

| Annual Cash Incentive | • As a percentage of target, awards were in the range of 69% - 100% for the named executive officers. • We exceeded the maximum performance measure for the return on capital metric of the annual cash incentive plan, but did not meet threshold level for the EPS performance measure. | |

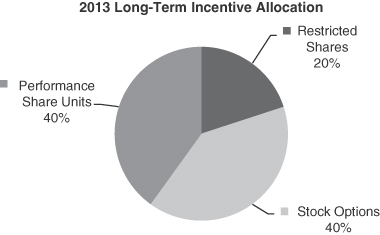

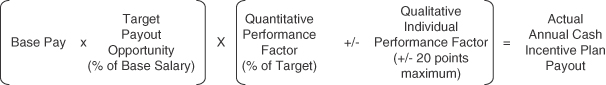

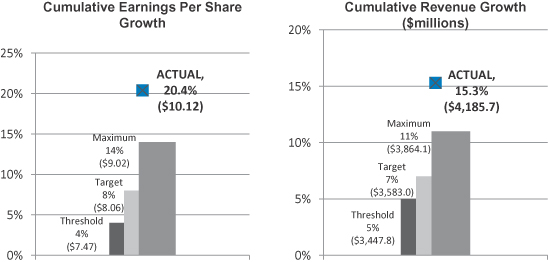

Long-Term Incentive | • Consistent with prior years’ practices, the Compensation Committee approved performance share grants based on a thorough review of competitive market data, individual and Company performance, and management’s recommendations. • Value mix: 40% stock options, 40% performance shares, and 20% restricted shares. • The fiscal year 2011 - 2013 performance period incentive plan payout was 200% of target based on performance confirmed by the Compensation Committee at the completion of the performance period. Our cumulative revenue was $4,185,658,000 and cumulative EPS was $10.12, both exceeding the maximum performance measure. | |

| Chief Executive Officer’s Total Direct Compensation | • Base Salary - $775,000 (6.9% increase over 2012) • Annual cash incentive award - $775,000 (at target - 100% of base salary). • Long-term incentives: g Stock Options - $1,051,974 ($24.46 per share - grant date fair value) g Restricted Shares - $492,720 ($61.59 per share - grant date fair value) g Performance Shares - $953,440 at target ($59.59 per share - grant date fair value) • Total: $4,048,134 |

4

NORDSON CORPORATION

FOR THE ANNUAL MEETING OF SHAREHOLDERS

FEBRUARY 25, 2014

The accompanying proxy is solicited on behalf of the Board of Directors (“Board”) of Nordson Corporation for use at the 2014 Annual Meeting of Shareholders of Nordson Corporation(“Annual Meeting”). The Annual Meeting will be held this year at the Atlanta Marriott Alpharetta, 5750 Windward Parkway, Alpharetta, Georgia 30005,Nordson Corporation’s Headquarters, 28601 Clemens Road, Westlake, Ohio 44145 at 8:00 a.m. on Tuesday, February 28, 2012, at 8:30 a.m.25, 2014 for the following purposes:

| 1. | To elect as directors three nominees, named in the Proxy Statement and recommended by the Board of Directors, to serve until the |

|

|

|

and

A Proxy Statement, Proxy/Voting Instruction Card, and Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the Fiscal Year ended October 31, 2011, accompany this Notice. The Board of Directors has determined that our shareholders of record at the close of business on January 3, 2012 are entitled to notice of, and to vote at, the Annual Meeting of Shareholders.

By Order of the Board of Directors,

ROBERT E. VEILLETTE

Vice President, General Counsel

and Secretary

Westlake, Ohio

January 23, 2012

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

FEBRUARY 28, 2012

The accompanying proxy is solicited on behalf of the Board of Directors (“Board”) of Nordson Corporation for use at the 2012 Annual Meeting of Shareholders (“Annual Meeting”). The Annual Meeting will be held at the Atlanta Marriott Alpharetta, 5750 Windward Parkway, Alpharetta, Georgia 30005, Tuesday, February 28, 2012, at 8:30 a.m. for the following purposes:

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the |

| 3. | To cast an advisory vote |

| 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

This Proxy Statement and the accompanying proxy/voting instruction card were first mailed to shareholders on or about January 23, 2012.17, 2014. Our 20112013 Annual Report to Shareholders is enclosed with this Proxy Statement.

This Proxy Statement contains important information regarding our Annual Meeting, the proposals on which you are being asked to vote, information you may find useful in determining how to vote, and information about voting procedures. As used herein, “we,” “us,” “our,” “Nordson” or the “Company” refers to Nordson Corporation.

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Shareholders to be held on February 28, 2012:25, 2014:

The Proxy Statement, proxy/voting instruction card and the Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the Fiscal Yearfiscal year ended October 31, 20112013, are available on our website at: www.nordson.com/investors.

25

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

Why am I receiving this Proxy Statement?You have been sent this Proxy Statement and proxy/voting instruction card(s) because you were a shareholder, or held Nordson common stock through a broker, bank or other third party, at the close of business on January 3, 2012,December 27, 2013, the record date for shareholders entitled to vote at the Annual Meeting. As of December 27, 2013, there were outstanding, excluding treasury shares which cannot be voted, 64,300,002 common shares entitled to one vote per share upon all matters presented to the shareholders.

What is a proxy? A proxy is your legal appointment of another person to vote the shares that you own in accordance with your instructions. The person you appoint to vote your shares is also called a proxy.

On the proxy/voting instruction card, you will find the names of the persons designated by the Company to act as proxies to vote your shares at the Annual Meeting. The proxies are required to vote your shares in the manner you instruct.

What is the record date for voting at the Annual Meeting? The record date for the 2012 Annual Meeting of Shareholders is January 3, 2012.

Who can attend the Annual Meeting? All shareholders of record as of the close of business on January 3, 2012December 27, 2013 may attend the meeting.

What proposals may I vote on at the Annual Meeting and how does the Board recommend I vote? The following matters will be voted on at the Annual Meeting:

# | Proposal | Board Recommendation | ||

1 | FOR ALL NOMINEES | |||

2 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for | FOR | ||

3 | FOR |

Will any other matters be voted on? We are not aware of any other matters on which you will be asked to vote at the Annual Meeting. If other matters are properly brought before the Annual Meeting, the proxy holders will use their discretion to vote on these matters as they may arise. Furthermore, if a nominee cannot or will not serve as director, then the proxy holders will vote for a replacement nominated by the Board. We do not expect any nominee to be unwilling to serve.

Who may vote? ShareholdersWhat is the difference between holding shares as a shareholder of record, a beneficial owner or a Nordson-sponsored retirement plan participant?

| • | Shareholder of record. If your shares are registered in your name with our transfer agent, Computershare Limited, you are considered the shareholder of record and these proxy materials have been sent directly to you. You may vote in person at the meeting. You may also grant us your proxy to vote your shares by telephone, via the Internet, or by mailing your signed proxy/voting instruction card in the postage-paid envelope provided. The card provides voting instructions. |

| • | Beneficial owner. If your shares are not held in your name but instead are held in a brokerage account, by a trustee, or by another nominee, then that other entity/holder is considered the shareholder of record and you are considered a beneficial owner of those shares. We sent these proxy materials to that other entity/holder, and they have been forwarded to you with a voting instruction card. As the beneficial owner, you have the right to direct your broker, trustee, or other nominee how to vote. Please refer to the information your broker, trustee, or other nominee provided to determine what voting options are available to you. |

6

| • | Shares held as a plan participant in the Nordson Corporation Employees’ Savings Trust (“401(k)”) Plan and/or Nordson Corporation Employee Stock Ownership Plan (collectively, the “Plans”). If you participate in one or both of these Plans you may have certain voting rights regarding shares of our common stock credited to your account in the Plans. You do not own these shares. They are owned by the Plan trustee. |

The Plans provide you with voting rights based on the number of shares that were constructively invested in your Plan account as of the close of business on January 3, 2012the record date. You may vote these shares in much the same way as shareholders of record vote their shares, but you have an earlier deadline.

You may vote the amount of shares credited to your account as of the record date for the Annual Meeting by telephone, via the internet, or by mailing your signed proxy/voting instruction card in the postage-paid envelope provided. Your vote must be received by the Plan trustee by11:59 p.m. Eastern Time February 20, 2014. You may vote these shares by following the instructions provided on the proxy/voting instruction card included with those materials.

By submitting voting instructions, you will direct the Plan trustee:

How to vote the shares allocated to your account in the Plan(s); and

How to vote a portion of the shares allocated to the accounts of other participants in the Plan(s) who have not submitted voting instructions by the deadline.

The trustee will submit one proxy to vote all shares in each of the Plans. The trustee will vote the shares of participants submitting voting instructions in accordance with their instructions and will vote the remaining shares in each of the Plans in the same proportion as the final votes of all participants who actually voted. Please note that, if you do not submit voting instructions for the shares in your account by the voting deadline, those shares will be included with the other undirected shares and voted by the trustee as described above. Because the trustee submits one proxy to vote all shares in the Plan, you may not vote Plan shares in person at the annual meeting.

How do I vote and what are the voting deadlines?

Shareholders of record and Plan participants. If you are a shareholder of record or a Plan participant, you may vote by proxy in any of the following three ways:

1.By telephone. If you reside in the United States or Canada, you may call1-800-690-6903, 24 hours a day, 7 days a week. Have your proxy/voting instruction card in hand when you call and follow the voice prompts to cast your vote.

2.Via the Internet. You may access the website atwww.proxyvote.com to cast your vote 24 hours a day, 7 days a week. With your proxy/voting instruction card in hand, follow the instructions provided to cast your vote.

3.By mail. You may mark, sign and date your proxy/voting instruction card and return it in the enclosed prepaid and addressed envelope. You do not need to mail the proxy/voting instruction card if you have voted by telephone or over the Internet.

The Internet and telephone voting procedures are designed to authenticate votes cast and allow shareholders to appoint a proxy and to confirm that their actions have been properly recorded. Specific voting instructions are set forth on the accompanying proxy/voting instruction card.

If you are a shareholder of record, your deadline to cast your vote by proxy is11:59 p.m., Eastern Time, on February 24, 2014. You may also vote in person at the Annual Meeting.

If you are a Plan participant, your deadline to cast your vote by proxy is11:59 p.m., Eastern Time, on February 20, 2014.

7

Beneficial Owners. If you are a beneficial owner, you should have received voting instructions from the broker, trustee or other nominee holding your shares. You should follow the instructions in the notice or voting instructions provided by your broker, trustee or nominee in order to instruct your broker, trustee or other nominee on how to vote your shares. The availability of telephone and Internet voting will depend on the voting process of the broker, trustee or nominee. Shares held beneficially may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker or nominee giving you the right to vote the shares.

All owners. If you receive more than one proxy/voting instruction card, it is important that you vote all shares represented by the multiple cards. Each card represents different shares.

May I change my vote? Yes. You may change your vote or revoke your proxy any time before the voting deadline.

Shareholders of record. If you are a shareholder of record, you may revoke your vote at any time before the final vote at the Annual Meeting by:

submitting a later-dated vote by telephone or via the Internet since only your latest Internet or telephone proxy received by 11:59 p.m., Eastern Time, on February 24, 2014 will be counted;

returning a later-dated, duly executed proxy card;

delivering a written revocation to our Corporate Secretary at 28601 Clemens Road, Westlake, Ohio 44145 before the Annual Meeting; or

| • | attending the Annual Meeting in personand voting again. |

Plan participants. If you are a Plan participant, you may revoke previously given voting instructions on or before February 20, 2014 by filing either a written notice of revocation or a properly completed and signed voting instruction card bearing a later date with New York Life Investment Management, the trustee.

Beneficial owners. If you are a beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions for changing your vote.

All owners. You will not revoke a proxy merely by attending the Annual Meeting. To revoke a proxy, you must take one of the actions described above.

What will happen if I do not vote my shares?

Shareholders of record. If you are the shareholder of record and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial owners. If you are the beneficial owner of your shares, your broker, trustee or nominee may vote your shares only on those proposals on which it has discretion to vote. AtUnder the rules of the Securities and Exchange Commission (the “SEC”), your broker, trustee or nominee does not have discretion to vote your shares on non-routine matters such as Proposals 1 and 3. Therefore, if you do not provide voting instructions to your broker, trustee or other nominee, your broker or other nominee may only vote your shares on Proposal 2 and any other routine matters properly presented for a vote at the Annual Meeting.

8

What if I do not specify how my shares are to be voted? If you are a shareholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted as indicated in the following table:

Proposal | Vote to be Cast | |

| Proposal 1 — Election of three nominees named in the Proxy Statement and recommended by the Board of Directors as directors to serve for a three-year term: Joseph P. Keithley, Michael J. Merriman, Jr., and Mary G. Puma | FOR ALL NOMINEES | |

| Proposal 2 — Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2014 | FOR | |

Proposal 3 — Advisory vote to approve named executive officer compensation | FOR |

What constitutes a quorum, and why is a quorum required? Our Regulations require a quorum of shareholders to hold our Annual Meeting. A quorum exists when at least a majority of the outstanding shares entitled to vote at the close of business on the record date there were 65,187,881are represented at the Annual Meeting either in person or by proxy. Your shares will be counted towards the quorum if you submit a proxy or vote at the Annual Meeting. Abstentions and broker non-votes (described below) will also count towards the quorum requirement. If a quorum is not achieved, a majority of the shares present at the Annual Meeting may adjourn the meeting to a later date.

What is a broker non-vote? Brokers or other nominees who hold Nordson common shares for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner. Your broker is not permitted to vote on your behalf on the election of directors and other non-routine matters unless you provide specific instructions to vote your shares. For your vote to be counted, you need to communicate your voting instructions to your broker, trustee or nominee.

A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes with respect to a particular proposal. Thus, a broker non-vote will not impact our ability to obtain a quorum and will not otherwise affect the outcome of the vote on a proposal that requires a plurality of votes cast (Proposal 1) or the approval of Proposal 2 since brokers have discretion to vote uninstructed shares on that proposal. Broker non-votes will affect the outcome of the vote on Proposal 3. It is important that you provide voting instructions for all shares you own beneficially.

What is the vote required for each proposal?

Proposal | Vote Required | Broker Discretionary Voting Permitted | Treatment of Abstentions | |||

| Proposal 1 — Election of three nominees named in the Proxy Statement and recommended by the Board of Directors, as directors to serve for a three-year term: Joseph P. Keithley, Michael J. Merriman, Jr., and Mary G. Puma | Plurality of votes cast | No | Not counted | |||

| Proposal 2 — Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2014 | Majority of the shares entitled to vote and present in person or represented by proxy | Yes | Will count as present and entitled to vote; will have the effect of a vote against the proposal | |||

| Proposal 3 — Advisory vote to approve named executive officer compensation | Majority of the shares entitled to vote and present in person or represented by proxy | No | Will count as present and entitled to vote; will have the effect of a vote against the proposal |

9

If cumulative voting is invoked, the proxy holders will vote all proxy cards received by them in such manner in accordance with cumulative voting as will assure the election of as many of our common stock outstandingnominees as possible.

Who will tabulate the votes? Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to receive and entitledtabulate shareholder votes. Broadridge will separately tabulate FOR, AGAINST and WITHHOLD votes, abstentions, and broker non-votes. The Inspector of Election will certify the election results and perform any other acts required by Ohio Corporation Law.

What happens if the Annual Meeting is adjourned or postponed? Your proxy will still be effective and will be voted at the rescheduled Annual Meeting. You will still be able to vote. Eachchange or revoke your proxy until it is voted.

Who is paying for the costs of this proxy solicitation? We will bear the expense of soliciting proxies. Proxies may also be solicited by Nordson personnel who will not receive additional compensation for such solicitation. Copies of proxy materials and the Annual Report to Shareholders will be supplied to brokers and other nominees for the purpose of soliciting proxies from beneficial owners.

How will I know the results of the Annual Meeting? The final voting results will be tallied by our Inspector of Election and published in a Current Report on Form 8-K filed with the SEC that we expect to file within four business days of the Annual Meeting.

Delivery of voting materials to shareholders sharing an address. To reduce the expense of delivering duplicate materials to shareholders sharing the same address, we have adopted a procedure approved by the SEC called “householding.” Under this procedure, certain shareholders of record who have the same address and last name will receive only one copy of the Annual Report to Shareholders and proxy materials until such time as one or more of these shareholders notifies us that they wish to receive individual copies. Shareholders of record in the same household continue to receive separate proxy/voting instruction cards.

We will mail materials that you request at no cost. You may contact us with your request by writing to or calling Corporate Communications, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio, 44145 or 440-414-5606. You may also access the Proxy Statement and Annual Report at: www.nordson.com/investors.

How do I submit director nominations or shareholder proposals for the 2015 Annual Meeting?

Shareholder Proposals Submitted Under Rule 14a-8

Assuming that our 2015 Annual Meeting is held within thirty days of the anniversary of the 2014 Annual Meeting, any shareholder who wishes to submit a proposal for consideration at the 2015 Annual Meeting and for inclusion in next year’s proxy statement under Rule 14a-8 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) should send the proposal c/o Secretary, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio 44145 for receipt on or before September 13, 2014.

Proposals and Director Nominations Submitted Pursuant to our Regulations

Additionally, under our Regulations, a shareholder may submit a proposal for consideration at the 2015 Annual Meeting, but not for inclusion in next year’s proxy statement, if the shareholder provides written notice no earlier than 90 days and no later than 60 days prior to the 2015 Annual Meeting. Assuming that the 2015 Annual Meeting will be held on February 24, 2015, that means notice of such proposals must be received no earlier than November 26, 2014 and no later than December 26, 2014. Our Regulations are available at: www.nordson.com/governance.

A shareholder may nominate a candidate for election as a director at the 2015 Annual Meeting provided the shareholder (i) is a shareholder of record at the time the shareholder gives notice of the

10

nomination, (ii) is entitled to vote at the meeting in the election of directors, and (iii) has given timely written notice of the nomination to the Secretary. Similar to the timeliness requirements under our Regulations described above, the notice of the nomination must be received no earlier than 90 days and no later than 60 days prior to the meeting. Assuming the 2015 Annual Meeting is held on February 24, 2015, the deadlines would be no earlier than November 26, 2014 and no later than December 26, 2014. The Governance and Nominating Committee will assess the qualifications of the candidate according to criteria set out in Nordson Corporation’s Governance Guidelines, which are available at: www.nordson.com/governance. For a candidate to be considered for election as a director or for business to be properly requested by a shareholder to be brought before an annual meeting of shareholders, the shareholder must comply with all of the requirements of our Regulations, not just the timeliness requirements described above. Any proposal for inclusion in the proxy materials, notice of proposal, or suggestion for nominee(s) for election to our Board of Directors should be sent to c/o Secretary, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio 44145.

If the notices delivered pursuant to the Regulations are not timely received, then we will not be required to present such proposals or nominations, as applicable, at the 2015 Annual Meeting. If the Board chooses to present any information submitted after the deadlines set forth in the Regulations (other than pursuant to Rule 14a-8 of the Exchange Act) at the 2015 Annual Meeting, then the persons named in proxies solicited by the Board for the 2015 Annual Meeting may exercise discretionary voting power with respect to such information.

YOUR VOTE IS VERY IMPORTANT, SO PLEASE VOTE.

Promptly return your proxy/voting instruction card or vote via telephone or the Internet,

which will help to reduce the cost of this solicitation.

This Proxy Statement and the enclosed proxy/voting instruction card are being mailed to shareholders of record on or about January 17, 2014. Nordson’s executive offices are located at 28601 Clemens Road, Westlake, Ohio 44145, telephone number (440) 892-1580.

PROPOSAL 1: ELECTION OF DIRECTORS WHOSE TERMS EXPIRE IN 2017

The Governance and Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Annual Meeting. The Governance and Nominating Committee has recommended to the Board, and the Board has approved, the persons named as nominees for terms expiring in 2017 and, unless otherwise marked, a proxy will be voted for such nominees. Messrs. Keithley and Merriman and Ms. Puma currently serve as directors. All nominees have agreed to stand for election for a three-year term.

In considering each director nominee and the composition of the Board of Directors as a whole, the Governance and Nominating Committee utilizes a diverse group of experiences, qualifications, attributes and skills, including diversity in gender, ethnicity and race, which the Governance and Nominating Committee believes enables a director nominee to make significant contributions to the Board, Nordson and our shareholders. Depending upon the skill sets being sought for a particular vacancy or addition to the Board, the following experiences have been included in our search criteria:

Active or recently retired chief executive officer, leading a sophisticated, business-to-business industrial enterprise ranging from $400 million to $1 billion plus revenues;

Experience in a company with a material percentage of sales (ideally at least 25 percent) derived from emerging markets;

A demonstrated track record of growing a company/division or supporting that growth through his/her role;

11

Experience in a company composed of multiple business units and having a demonstrated experience in technology and R&D based environments;

A demonstrated concern for society and a view of the role of a corporation in society, which is consistent with the traditional values of Nordson Corporation.

It is intended that proxies that are submitted but do not withhold the authority to vote for any or all of the nominees will be voted for the election as directors of all of the nominees named below. At this time, the Board knows of no reason why any nominee might not be a candidate at the 2014 Annual Meeting. However, in the event any one vote per share.or more of such nominees becomes unavailable for election, proxies will be voted in accordance with the best judgment of the proxy holder.

The name and age of each of the three nominees for election as directors for terms expiring in 2017, as well as present directors whose terms will continue after the meeting, appear below together with his or her principal occupation for at least the past five years, the year each became a director of the Company and certain other information.

Nominees For Terms Expiring in 2017

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||||

Joseph P. Keithley | 65 | Business Experience. Mr. Keithley has served as Chairman of the Board of Nordson Corporation since February 2010. He served as Chairman of the Board of Keithley Instruments, Inc., a provider of measurement solutions to the semiconductor, fiber optics, telecommunications and electronics industries from 1991, as well as a member of its Board of Directors from 1986 until December 2010 when Keithley Instruments was purchased by Danaher Corporation. He also served as Keithley Instruments’ Chief Executive Officer from November 1993 to December 2010 and as President from May 1994 to December 2010. | 2001 | |||||||

| Other Directorships in Previous 5 Years. Mr. Keithley previously served as Chairman of the Board of Keithley Instruments. He currently serves as a director of Materion Corporation (NYSE: MTRN), an integrated producer of high performance engineered materials used in a variety of electrical, electronic, thermal and structural applications, and Axcelis Technologies, Inc. (NASDAQ GS: ACLS), a provider of equipment and service solutions for the semiconductor manufacturing industry. | ||||||||||

| Key Attributes, Experiences and Skills. Mr. Keithley brings extensive, broad-based international business and executive management and leadership experience from his leadership roles at Keithley Instruments to his role as Chairman of our Board of Directors. Among other things, Mr. Keithley draws upon his extensive knowledge in the global semiconductor and electronics industries garnered while leading Keithley Instruments. Mr. Keithley also has extensive public company board and governance experience. | ||||||||||

Michael J. Merriman, Jr. | 57 | Business Experience. Mr. Merriman has been an Operating Advisor of Resilience Capital Partners LLC since June 2008. Resilience is a private equity firm focused on principal investing in lower middle market underperforming and turnaround situations. Mr. Merriman is a business consultant for Product Launch Ventures, LLC, a company that he founded in 2004 to pursue consumer product opportunities and provide business advisory services. Mr. Merriman served as President and Chief Executive Officer of The Lamson & Sessions Co., a manufacturer of thermoplastic conduit, fittings and electrical switch and outlet boxes from November 2006 to November 2007. Mr. Merriman | 2008 | |||||||

12

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||||

| served as Senior Vice President and Chief Financial Officer of American Greetings Corporation (formerly, NYSE: AM), a designer, manufacturer and seller of greeting cards and other social expression products from September 2005 until November 2006. | ||||||||||

| Other Directorships in Previous 5 Years. Mr. Merriman is presently a director of Regis Corporation (NYSE: RGS), the beauty industry’s global leader in beauty salons, hair restoration centers and cosmetology education, and OMNOVA Solutions Inc. (NYSE: OMN), a technology-based company and an innovator of emulsion polymers, specialty chemicals, and decorative and functional surfaces for a variety of commercial, industrial and residential end uses. Mr. Merriman was a director of American Greetings from 2006 through August 2013 when American Greetings became a private company. Mr. Merriman also served as a director from 2004 until April 2011 for RC2 Corporation, a manufacturer of pre-school toys and infant products. | ||||||||||

| Key Attributes, Experiences and Skills. Mr. Merriman’s prior experience as a public company chief executive officer and chief financial officer and his current service on the boards of directors of two publicly traded companies, as well as his experience at Resilience, provides him with valuable experience and significant knowledge in the areas of executive management, strategy, corporate governance, acquisitions and divestitures, finance and financial reporting, product development expertise, and investor relations. Mr. Merriman has significant finance, financial reporting and accounting expertise and was formerly a certified public accountant, which provides the Board with valuable expertise and qualifies him as a “financial expert” on the Audit Committee, as described under the “Audit Committee” caption in Corporate Governance section of this Proxy Statement. | ||||||||||

Mary G. Puma | 55 | Business Experience. Ms. Puma has served as Chairman of the Board of Axcelis Technologies, Inc. (NASDAQ GS: ACLS) since May 2005 and chief executive officer since January 2002. Axcelis is a provider of equipment and service solutions for the semiconductor manufacturing industry. | 2001 | |||||||

| Other Directorships in Previous 5 Years. Ms. Puma is presently Chairman of the Board of Axcelis Technologies. | ||||||||||

| Key Attributes, Experiences and Skills. Ms. Puma contributes extensive general management experience in an international, technology-driven business and possesses a thorough knowledge of corporate governance and strategy development. Ms. Puma brings valuable experience in compensation and talent management planning matters to our Compensation and Governance & Nominating Committees, respectively. | ||||||||||

Present Directors Whose Terms Expire in 2015

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

Arthur L. George, Jr. | 52 | Business Experience. Mr. George has served as Senior Vice President and Manager, Analog Engineering Operations of Texas Instruments Incorporated (NASDAQ GS: TXN) since 2011. Texas Instruments is one of the world’s largest semiconductor companies and a highly innovative, high performing global leader in analog, embedded processing and wireless technologies.Mr. George was Senior Vice President and Worldwide General Manager, High Performance Analog of Texas Instruments from 2006 to 2011. | 2012 | |||||

13

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

| Key Attributes, Experiences and Skills. Mr. George brings to the Board significant executive general management experience as well as extensive operational and new product development experiences in high technology markets. Mr. George’s experience with High Performance Analog products used in a wide range of industrial products gives him insight on a diverse set of industries and affords the Board a unique perspective in identifying strategic and tactical risks attendant to the semiconductor electronics market. | ||||||||

Frank M. Jaehnert | 56 | Business Experience. Mr. Jaehnert served as Chief Executive Officer and President of Brady Corporation (NYSE: BRC) from April 1, 2003 through October 7, 2013. Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect premises, products and people. Brady’s core capabilities in manufacturing, channel management, printing systems, precision engineering and materials expertise make it a leading supplier to customers in general manufacturing, maintenance and safety, process industries, construction, electrical, telecommunications, electronics, laboratory/healthcare, airline/transportation, brand protection, education, governmental, public utility, and a variety of other industries. | 2012 | |||||

| Other Directorships in Previous 5 Years. Mr. Jaehnert served as a director of Brady Corporation from April 1, 2003 through October 7, 2013. | ||||||||

| Key Attributes, Experiences and Skills. Mr. Jaehnert brings extensive, broad-based international business and executive management and leadership experience to our Board, and, coupled with a demonstrated execution of strategic vision and a well-developed understanding of accounting and financial matters, compliments strongly the skill sets of our present directors. Mr. Jaehnert’s significant finance, financial reporting and accounting background provides the Board with valuable expertise and qualifies him as a “financial expert” on the Audit Committee, as described under the “Audit Committee” caption in Corporate Governance section of this Proxy Statement. | ||||||||

Present Directors Whose Terms Expire in 2016

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

Lee C. Banks | 50 | Business Experience. Mr. Banks has served as Executive Vice President and Operating Officer of Parker Hannifin Corporation since 2008. Parker Hannifin Corporation (NYSE: PH) is the world’s leading diversified manufacturer of motion and control technologies and systems, providing precision-engineered solutions for a wide variety of mobile, industrial and aerospace markets. Mr. Banks was Senior Vice President and Operating Officer of Parker Hannifin from 2006 to 2008 and served as its Worldwide President, Hydraulics Group, from 2003 to 2006. | 2010 | |||||

| Key Attributes, Experiences and Skills. As a senior executive with a multinational corporation, Mr. Banks provides the Board with significant executive general management and operational experiences and a unique perspective in identifying strategic and tactical risks attendant to a multinational sales, distribution, manufacturing and operational footprint. | ||||||||

14

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

Randolph W. Carson | 62 | Business Experience. From 2000 to February 2009, Mr. Carson served as Chief Executive Officer of Eaton Corporation (NYSE: ETN) Electrical Group. Eaton is a global diversified industrial manufacturer and technology leader in electrical components and systems for power quality, distribution and control. Mr. Carson retired from Eaton in May 2009 following ten years with the company. Prior to Eaton Corporation, Mr. Carson held several executive positions with Rockwell International. | 2009 | |||||

| Other Directorships in Previous 5 Years. Mr. Carson is presently a director of Fairchild Semiconductor Inc. (NYSE: FSC), a leading global manufacturer of semiconductor devices; Graftech International Inc. (NYSE: GTI), a global manufacturer of carbon and graphite products; and the Southwire Company, the leading North American supplier of wire and cable products. | ||||||||

| Key Attributes, Experiences and Skills. Our Board believes that Mr. Carson’s deep operational experience in global industrial businesses enables him to provide unique insight to our Board with respect to meeting marketplace challenges, implementing Lean and other productivity initiatives, integrating business units and anticipating and planning for commercial risk and uncertainties. Together with his experience, strategic vision and understanding of financial accounting and financial matters, our Board believes Mr. Carson is well qualified to serve as a member of our Board. Mr. Carson’s public company board experience contributes to his familiarity with current issues and his ability to identify and address matters that come before the Governance & Nominating and Audit Committees on which he serves. | ||||||||

Michael F. Hilton | 59 | Business Experience. Mr. Hilton became Nordson’s President and Chief Executive Officer effective January 16, 2010. Prior to his joining Nordson, Mr. Hilton was Senior Vice President and General Manager for Air Products and Chemicals, Inc. (NYSE: ADP) from 2007 until 2010 with specific responsibility for leading the company’s $2 billion global Electronics and Performance Materials segment. Air Products and Chemicals serves customers in industrial, energy, technology and healthcare markets worldwide with a unique portfolio of atmospheric gases, process and specialty gases, performance materials, and equipment and services. | 2010 | |||||

| Other Directorships in Previous 5 Years. Mr. Hilton serves as a director of Ryder System, Inc. (NYSE: R), a FORTUNE® 500 provider of leading-edge transportation, logistics and supply chain management solutions. | ||||||||

| Key Attributes, Experiences and Skills. Mr. Hilton is the only member of Nordson’s management serving on the Board. With over 30 years of global manufacturing industry experience, Mr. Hilton brings to the Board an intimate understanding of management leadership, strategy development and day-to-day operations of a multinational company, including product line management, new product technology and talent development, manufacturing, distribution and other sales channels, business processes, international operations and global markets. | ||||||||

Victor L. Richey, Jr. | 56 | Business Experience. Mr. Richey has served as Chairman of the Board, President and Chief Executive Officer of ESCO Technologies, Inc. (NYSE: ESE) since 2003. ESCO Technologies is a diversified manufacturer of special purpose utility solutions for electric, gas and water utilities, including hardware and software to support advanced metering applications and fully automated intelligent instrumentation; and engineered filtration products to the aviation, space and process | 2010 | |||||

15

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||

| markets worldwide. ESCO Technologies is the industry leader in radio frequency shielding and electromagnetic compatibility test products. | ||||||

| Other Directorships in Previous 5 Years. Mr. Richey is presently Chairman of the Board of ESCO Technologies. | ||||||

| Key Attributes, Experiences and Skills. The Board believes Mr. Richey provides a breadth of skills critical to the Board’s ability to discharge its oversight responsibility. Mr. Richey has extensive experience as Chairman, President and Chief Executive Officer of a diversified global producer and marketer of technology, and he has significant executive management and board experience at public and private companies within some of our end markets, including the semiconductor industry. |

Former director, William L. Robinson, retired from our Board in 2013 pursuant to the Company’s Governance Guidelines which provide that a director is expected to retire from service as a director at the end of the Board meeting that precedes his or her 72nd birthday.

No shareholder or group that beneficially owns 1% or more of our outstanding common shares has recommended a candidate for election as a director at the 2014 Annual Meeting.

Cumulative Voting

Voting for directors will be cumulative if any shareholder provides notice in writing to the President, a Vice President or the Secretary of Nordson of a desire to have cumulative voting. The notice must be received at least 48 hours before the time set for the Annual Meeting, and an announcement of the notice must be made at the beginning of the meeting by the Chairman or the Secretary, or by or on behalf of the shareholder giving the notice. If cumulative voting is in effect, each shareholder will be entitled to cast, in the election of directors, a number of votes equal to the product of the number of directors to be elected multiplied by the number of shares that the shareholder is voting. Shareholders may cast all of these votes for one nominee or distribute them among several nominees, as they see fit. If cumulative voting is in effect, shares represented by each properly submitted proxy will also be voted on a cumulative basis, with the votes distributed among the nominees in accordance with the judgment of the persons named on the proxy/voting instruction card.

3

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

|

|

|

How do I vote and what are the voting deadlines?

Shareholders of Record. If you are a shareholder of record, there are several ways for you to vote your shares:

|

|

|

Beneficial Owners. If you are a beneficial owner of your shares, you should have received voting instructions from the broker, trustee or other nominee holding your shares. You should follow the instructions in the notice or voting instructions provided by your broker, trustee or nominee in order to instruct your broker, trustee or other nominee on how to vote your shares. The availability of telephone and Internet voting will depend on the voting process of the broker, trustee or nominee. Shares held beneficially may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker or nominee giving you the right to vote the shares.

4

All Owners. If you receive more than one proxy card and/or voting instruction card, it is important that you vote all shares represented by the multiple cards. Each card represents different shares.

May I change my vote? Yes. You may change your vote or revoke your proxy any time before the Annual Meeting.

Shareholders of Record. If you are a shareholder of record, you may revoke your vote at any time before the final vote at the Annual Meeting by:

submitting a later-dated vote by telephone or via the Internet since only your latest Internet or telephone proxy received by 11:59 p.m. Eastern Time on February 27, 2012 will be counted;

returning a later-dated proxy card;

delivering a written revocation to our Corporate Secretary at 28601 Clemens Road, Westlake, Ohio 44145 before the Annual Meeting; or

|

Beneficial Owners. If you are a beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions for changing your vote. For 401(k) plan and ESOP shares, you may revoke previously given voting instructions on or before February 23, 2012 by filing either a written notice of revocation or a properly completed and signed voting instruction card bearing a laterTo date, with New York Life Investment Management, the trustee.

What will happen if I do not vote my shares?

Shareholders of Record. If you are the shareholder of record and you do not vote by proxy card, by telephone, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner of your shares, your broker, trustee or nominee may vote your shares only on those proposals on which it has discretion to vote. Under the rules of the Securities and Exchange Commission, your broker, trustee or nominee does not have discretion to vote your shares on non-routine matters such as Proposals 1 and 3. Therefore, if you do not provide voting instructions to your broker, trustee or other nominee, your broker or other nominee may only vote your shares on Proposal 2 and any other routine matters properly presented for a vote at the Annual Meeting.

What if I do not specify how my shares are to be voted? If you are a shareholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted as indicated in the following table:

| ||

| ||

|

What constitutes a quorum, and why is a quorum required? Our Regulations require a quorum of shareholders to hold our Annual Meeting. A quorum exists when at least a majority of the outstanding shares entitled to vote at the close of business on the record date (January 3, 2012) are represented at the Annual Meeting either in person or by proxy. Your shares will be counted towards the quorum if you submit a proxy or vote at the Annual Meeting. Abstentions and broker non-votes (described below) will also count towards the quorum requirement. If a quorum is not achieved, a majority of the shares present at the Annual Meeting may adjourn the meeting to a later date.

5

What is the effect of a broker non-vote? Brokers or other nominees who hold Nordson common shares for a beneficial owner have the discretion to vote on routine proposals when theywe have not received voting instructionsa notice from the beneficial owner at least ten days prior to the Annual Meeting. Your broker is not permitted to vote on your behalf on the election of directors and other non-routine matters unless you provide specific instructions by completing and returning the proxy card or following the instructions provided to you by your broker, trustee or nominee to vote your shares via telephone or the Internet. For your vote to be counted, you need to communicate your voting instructions to your broker, trustee or nominee.

A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, a broker non-vote will not impact our ability to obtain a quorum and will not otherwise affect the outcome of the vote on a proposal that requires a plurality of votes cast (Proposal 1) or the approval of Proposal 2 since brokers have discretion to vote uninstructed shares on that proposal. Broker non-votes will affect the outcome of the vote on Proposal 3. It is important that you provide voting instructions for all shares you own beneficially.

What is the vote required for each proposal?

|

|

| ||

With respect to Proposal 1, you may vote FOR all nominees, WITHHOLD your vote as to all nominees, or vote FOR all nominees except those specific nominees from whom you WITHHOLD your vote. Nominees receiving the most FOR votes will be elected. A properly executed proxy marked WITHHOLD with respect to the election of one or more nominees will not be voted with respect to the nominee or nominees indicated. Proxies may not be voted for more than three nominees.

With respect to Proposals 2 and 3, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposals 2 or 3, the abstention will have the same effect as an AGAINST vote.

Who will count the votes? Broadridge Financial Solutions, Inc. has been engaged as our independent agent to receive and tabulate shareholder votes. Broadridge will separately tabulate FOR, AGAINST and WITHHOLD votes, abstentions, and broker non-votes. The Inspectors of Election will certify the election results and perform any other acts required by Ohio Corporation Law.

What happens if the annual meeting is adjourned or postponed? Your proxy will still be effective and will be voted at the rescheduled Annual Meeting. You will still be able to change or revoke your proxy until it is voted.

Who is paying for the costs of this proxy solicitation? We will bear the expense of soliciting proxies. Proxies may also be solicited in person, by telephone or electronically by Nordson personnel who will not receive additional compensation for such solicitation. Copies of proxy materials and the Annual Report to Shareholders will be supplied to brokers and other nominees for the purpose of

6

soliciting proxies from beneficial owners, and we will reimburse such brokers or other nominees for their reasonable expenses.

How will I know the results of the Annual Meeting? The final voting results will be tallied by our Inspectors of Elections and published in a Current Report on Form 8-K that we expect to file within four business days of the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to disclose preliminary voting results and, within four business days after the final results are known, we will file an additional Form 8-K to disclose the final voting results.

Delivery of voting materials to shareholders sharing an address. To reduce the expense of delivering duplicate materials to shareholders sharing the same address, we have adopted a procedure approved by the Securities and Exchange Commission called “householding.” Under this procedure, certain shareholders of record who have the same address and last name will receive only one copy of the Annual Report to Shareholders and proxy materials until such time as one or more of these shareholders notifies us that they wish to receive individual copies. Shareholders of record in the same household continue to receive separate proxy cards.

We will mail materials that you request at no cost. You may contact us with your request by writing to or calling Corporate Communications, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio, 44145 or 440-414-5606. You can also access the Proxy Statement and Annual Report online on our website at: www.nordson.com/investors.

How do I submit director nominations or shareholder proposals for the 2013 Annual Meeting?

Shareholder Proposals Submitted Under Rule 14a-8

Assuming that our 2013 Annual Meeting is held within thirty days of the anniversary of the 2012 Annual Meeting, any shareholder who wishes to submit a proposal for consideration at next year’s meeting and for inclusion in next year’s proxy statement under Rule 14a-8 of the Securities Exchange Act of 1934 should send the proposal c/o Secretary, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio 44145 for receipt on or before September 25, 2012.

Proposals and Director Nominations Submitted Pursuant to our Regulations

Additionally, under our Regulations, a shareholder may submit a proposal for consideration at next year’s Annual Meeting of Shareholders, but not for inclusion in the Proxy Statement, if the shareholder provides written notice no earlier than 90 days and no later than 60 days prior to the 2013 Annual Meeting. Assuming that the 2013 Annual Meeting will be held on February 26, 2013, that means notice of such proposals must be received no earlier than November 28, 2012 and no later than December 28, 2012. The Company will publicly announce the date of the 2013 Annual Meeting in a timely manner. Our Regulations are available on our website at: www.nordson.com/governance.

A shareholder may nominate a candidate for election as a director at the 2013 Annual Meeting of the Shareholders provided the shareholder (i) is a shareholder of record at the time the shareholder gives notice of the nomination, (ii) is entitled to vote at the meeting in the election of directors, and (iii) has given timely written notice of the nomination to the Secretary. Similar to the timeliness requirements under our Regulations described above, the notice of the nomination must be received no earlier than 90 days and no later than 60 days prior to the meeting. Assuming the 2013 Annual Meeting is held on February 26, 2013, the deadlines would be no earlier than November 28, 2012 and no later than December 28, 2012. The Governance and Nominating Committee will assess the qualifications of the candidate according to criteria set out in Nordson Corporation’s Governance Guidelines, which are available on our website at: www.nordson.com/governance. For a candidate to be considered for election as a director or for business to be properly requested by a shareholder to be brought before an annual meeting of shareholders, the shareholder must comply with all of the requirements of our

7

Regulations, not just the timeliness requirements described above. All proposals for inclusion in the proxy materials, notices of proposals, suggestions for nominees for election to our Board should be sent to c/o Secretary, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio 44145.

If the notices delivered pursuant to the Regulations are not timely received, then we will not be required to present such proposals or nominations, as applicable, at the 2013 Annual Meeting. If the Board chooses to present any information submitted after the deadlines set forth in the Regulations (other than pursuant to Rule 14a-8 of the Securities Exchange Act of 1934) at the 2013 Annual Meeting, then the persons named in proxies solicited by the Board for the 2013 Annual Meeting may exercise discretionary voting power with respect to such information.

YOUR VOTE IS VERY IMPORTANT, SO PLEASE VOTE.

Promptly return your proxy card or vote via telephone or the Internet,

which will help to reduce the cost of this solicitation.

This Proxy Statement and the enclosed proxy card are being mailed to shareholders of record on or about January 23, 2012. Nordson’s executive offices are located at 28601 Clemens Road, Westlake, Ohio 44145, telephone number (440) 892-1580.

PROPOSAL 1: ELECTION OF DIRECTORS WHOSE TERMS EXPIRE IN 2015

Our Regulations require us to have at least nine directors with not less than three directors in each of three classes. Each of the directors serves for a term of three years and until a qualified successor is elected. The Board currently has nine directors.

The Governance and Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at the Annual Meeting of Shareholders. The Governance and Nominating Committee has recommended to the Board, and the Board has approved, the persons named as nominees for terms expiring in 2015 and, unless otherwise marked, a proxy will be voted for such nominees. Mr. Merriman currently serves as a director, last elected by the shareholders at the 2009 Annual Meeting. All nominees have agreed to stand for election to a three-year term.

It is intended that proxies that are submitted but do not withhold the authority to vote for any or all of the nominees will be voted for the election as directors of all of the persons named below. At this time, the Board knows of no reason why any nominee might not be a candidate at the 2012 Annual Meeting.

The name and age of each of the three nominees for election as directors for terms expiring in 2015, as well as present directors whose terms will continue after the meeting, appear below together with his or her principal occupation for at least the past five years, the year each became a director of the Company and certain other information.

8

Nominees For Terms Expiring in 2015

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

Arthur L. George, Jr. | 50 | Business Experience. Mr. George has served as Senior Vice President and Manager, Analog Engineering Operations of Texas Instruments Incorporated (NASDAQ GS: TXN) since 2011. Texas Instruments is one of the world’s largest semiconductor companies and a highly innovative, high performing global leader in analog, embedded processing and wireless technologies.Mr. George was Senior Vice President and Worldwide General Manager, High Performance Analog of Texas Instruments from 2006 to 2011. | — | |||||

| Key Attributes, Experiences and Skills. Mr. George brings to the Board significant executive general management experience as well as extensive operational and new product development experiences in high technology markets. Mr. George’s experience with High Performance Analog products used in a wide range of industrial products gives him insight to a diverse set of industries and affords the Board a unique perspective in identifying strategic and tactical risks attendant to the semiconductor electronics market. | ||||||||

Frank M. Jaehnert | 54 | Business Experience. Mr. Jaehnert has been Chief Executive Officer and President of Brady Corporation (NYSE: BRC) since April 1, 2003. Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect premises, products and people. Brady’s core capabilities in manufacturing, channel management, printing systems, precision engineering and materials expertise make it a leading supplier to customers in general manufacturing, maintenance and safety, process industries, construction, electrical, telecommunications, electronics, laboratory/healthcare, airline/transportation, brand protection, education, governmental, public utility, and a variety of other industries. | — | |||||

| Key Attributes, Experiences and Skills. Mr. Jaehnert brings extensive, broad-based international business and executive management and leadership experience to our Board, and, coupled with a demonstrated execution of strategic vision and a well-developed understanding of financial accounting and financial matters, compliments strongly the skill sets of our present directors. | ||||||||

Michael J. Merriman, Jr. | 55 | Business Experience. Mr. Merriman has been an Operating Advisor of Resilience Capital Partners LLC since June 2008. Resilience is a private equity firm focused on principal investing in lower middle market underperforming and turnaround situations. Mr. Merriman is a business consultant for Product Launch Ventures, LLC, a company that he founded in 2004 to pursue consumer product opportunities and provide business advisory services. Mr. Merriman served as President and Chief Executive Officer of The Lamson & Sessions Co., a manufacturer of thermoplastic conduit, fittings and electrical switch and outlet boxes from November 2006 to November 2007. Mr. Merriman served as Senior Vice President and Chief Financial Officer of American Greetings Corporation (NYSE: AM), a designer, manufacturer and seller of greeting cards and other social expression products from September 2005 until November 2006. | 2008 | |||||

9

|

| |||||

Present Directors Whose Terms Expire in 2013

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

Lee C. Banks | 48 | Business Experience. Mr. Banks has served as Executive Vice President and Operating Officer of Parker Hannifin Corporation since 2008. Parker Hannifin Corporation (NYSE: PH) is the world’s leading diversified manufacturer of motion and control technologies and systems, providing precision-engineered solutions for a wide variety of mobile, industrial and aerospace markets. Mr. Banks was Senior Vice President and Operating Officer of Parker Hannifin from 2006 to 2008 and served as its Worldwide President, Hydraulics Group from 2003 to 2006. | 2010 | |||||

| Key Attributes, Experiences and Skills. As a senior executive with a multinational corporation, Mr. Banks provides the Board with significant executive general management and operational experiences and a unique perspective in identifying strategic and tactical risks attendant to a multinational sales, distribution, manufacturing and operational footprint. | ||||||||

Randolph W. Carson | 60 | Business Experience. From 2000 to February 2009, Mr. Carson served as Chief Executive Officer of the Electrical Group of Eaton Corporation (NYSE: ETN), a global diversified industrial manufacturer and technology leader in electrical components and systems for power quality, distribution and control. Mr. Carson retired from Eaton in May 2009 following 10 years with the company. Prior to Eaton Corporation, Mr. Carson held several executive positions with Rockwell International. | 2009 | |||||

| Other Directorships in Previous 5 Years. Mr. Carson is presently a director of Fairchild Semiconductor Inc. (NYSE: FSC), a leading global manufacturer of semiconductor devices; Graftech International Inc. (NYSE: GTI), a global manufacturer of carbon and graphite products; and the Southwire Company, the leading North American supplier of wire and cable products. | ||||||||

10

Name | Age | Business Experience and Directorships for Previous Five Years and Qualifications to Serve | Director Since | |||||

| Key Attributes, Experiences and Skills. Our Board believes that Mr. Carson’s deep operational experience in global industrial businesses enables him to provide unique insight to our Board with respect to meeting marketplace challenges, implementing LEAN and other productivity initiatives, integrating business units and anticipating and planning for commercial risk and uncertainties. Together with his experience, strategic vision and understanding of financial accounting and financial matters, our Board believes Mr. Carson is well qualified to serve as a member of our Board. Mr. Carson’s public company board experience contributes to his familiarity with current issues that assists in identifying and addressing matters that come before the Governance & Nominating and Audit Committees on which he serves. | ||||||||

Michael F. Hilton | 57 | Business Experience. Mr. Hilton became Nordson’s President and Chief Executive Officer effective January 16, 2010. Prior to his joining Nordson, Mr. Hilton was Senior Vice President and General Manager for Air Products and Chemicals Inc. (NYSE: ADP) with specific responsibility for leading the company’s $2 billion global Electronics and Performance Materials segment. From October 2006 through September 2007, Mr. Hilton was Vice President and General Manager of Air Products and Chemicals’ Electronics and Performance Materials segment. Mr. Hilton served as Air Products and Chemicals’ Vice President, Electronics Business from 2003 to 2006. Air Products and Chemicals Inc. serves customers in industrial, energy, technology and healthcare markets worldwide with a unique portfolio of atmospheric gases, process and specialty gases, performance materials, and equipment and services. | 2010 | |||||

| Key Attributes, Experiences and Skills. Mr. Hilton is the only member of Nordson’s management serving on the Board. Mr. Hilton has over 30 years of global manufacturing industry experience. Mr. Hilton brings to the Board an intimate understanding of management leadership, strategy development and day-to-day operations of a multinational company, including product line management, new product, technology and talent development, manufacturing, distribution and other sales channels, business processes, international operations and global markets. | ||||||||